Senator Bernie Sanders’ plan would fund Social Security through 2060 by making the rich pay their fair share

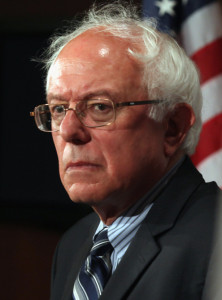

Senator Bernie Sanders

Every worker is familiar with Social Security taxes, the 6.2 percent of earnings that is taken out of every paycheck to fund the Social Security system. This is how retired people and people with disabilities are able to receive benefits without Social Security adding anything to the national deficit. However, many people are unaware that high income earners pay a lower percentage of their income in Social Security taxes. That is because the amount of earnings that are subject to the payroll tax is capped at $118,500. This is the opposite of a progressive tax such as the federal income tax, in which higher earners pay a higher percentage of their incomes. With the payroll tax, nine out of ten Americans pay the same percentage, but the rich pay a lower percentage the richer they get.

Senator Bernie Sanders thinks this is unfair, and he has proposed eliminating the cap, so that all workers will pay the same percentage. Republicans in Congress have manufactured a crisis in the Social Security system, by refusing to consider the normally non-controversial reallocation of funds from the retirement trust fund to the disability trust fund, unless it is also accompanied by cuts in benefits or higher taxes. Sen. Sanders has met their challenge with a proposal that would indeed raise taxes, but only on those who can most easily afford it, and only to the degree that all other workers must pay. Sanders said that the Social Security actuary has projected that such a change would fully fund the Social Security system through at least 2060.

Sen. Sanders is an independent Senator from Vermont and possible Presidential candidate in 2016. He has consistently argued in favor of not just defending Social Security from budget cuts, but expanding the program.